Valuation Too High at Berkeley Lights ($BLI)

ARK has added to $BLI in recent days amidst market volatility

Berkeley Lights, Inc. is a digital cell biology company that focuses on enabling and accelerating the rapid development and commercialization of biotherapeutics and other cell-based products. The company offers an integrated platform, which comprise of proprietary consumables, including OptoSelect chips and reagent kits, automation systems, and application and workflow software. The company was incorporated in 2011 and is based in Emeryville, California.

The company has had a volatile history, and investors can currently gain exposure to the biotechnology company at near all-time lows. Investors who want to do a deep dive on the company should start with their recent JP Morgan Healthcare conference presentation, here.

CEO Eric Hobbs made a compelling case for BLI’s cell biology platform. Increasingly, development-stage biotherapeutics companies are relying on biologics as part of their product development efforts. BLI is the supplier of “picks and shovels” to this gold rush that should become more apparent over the next 10-20 years.

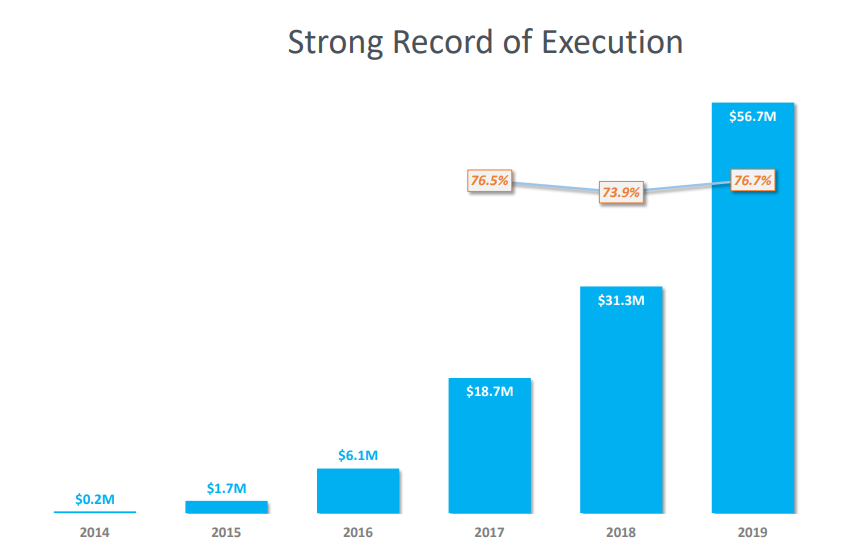

The company has a strong revenue growth history over the past years. While still small relative to the company’s market cap in excess of $3 billion, the question is whether BLI’s progress in developing its technology platform will continue to scale aggressively to justify the company’s current valuation.

As announced on the latest earnings call, the company has 8 “current workflows”, up from 6 in the most recent quarter. One of the new workflows is a workflow for viral vectors. The company management team also recently presented quite strong guidance relative to analyst expectations, which is clear from a close reading of the analyst Q&A on the latest call.

BLI currently estimates its total addressable market opportunity at $23 billion. If this is the case, the company’s current market cap is likely somewhat overvalued in my opinion. There is still much to be proven.

I don’t think many people are following this company very closely, aside from ARK’s involvement in the story. The future is uncertain, but I think BLI is a company worth watching, especially if the valuation decreases to more reasonable levels, as I have a feeling the company will play an increasingly important role in biotechnology as a result of the strength of its cell biology platform.