Attractive Setup on NanoString ($NSTG)

Longtime watchers of ARK and other top funds are familiar with this innovative biotech company.

NanoString ($NSTG) is a familiar name for longtime watchers of the ARK actively managed ETF complex and other top biotech funds. The stock price has pulled back considerably from its recent highs, so is it a good buy at these prices? What does the company actually do, and how much is it worth?

NanoString Technologies, Inc. ($NSTG) develops, manufactures, and sells tools for scientific and clinical research in the fields of genomics and proteomics in the Americas, Europe, the Middle East, and the Asia Pacific.

The company offers nCounter Analysis System, an automated, multi-application, digital detection, and counting system.

It provides nCounter MAX and FLEX systems that include Prep Station, an automated liquid handling component that processes and prepares samples for data collection; and nCounter Digital Analyzer, which collects data from samples by taking images of the immobilized fluorescent reporters in the sample cartridge and processing the data into output files.

The company also offers nCounter SPRINT Profiler, an instrument that provides liquid handling steps and the digital analysis through use of a microfluidic cartridge; and nSolver Analysis Software, a data analysis program that enables researchers to check, normalize, and analyze their data.

In addition, it provides custom CodeSets; panels with oncology, immunology and infectious disease, and neuroscience applications.

Further, the company offers nCounter based reagents that allow users to design customized assays; Master Kits, such as ancillary reagents and plasticware to setup and process samples in the nCounter Prep Station and nCounter Digital Analyzer; and Prosigna molecular diagnostic test kits.

The company is also developing GeoMx DSP system to enable the field of spatial genomics; and Hyb & Seq technologies. It has collaboration with Lam Research Corporation for the research and development of Hyb & Seq technologies; and Celgene Corporation for developing LymphMark, an in vitro diagnostic for the treatment of diffuse large B-cell lymphoma.

NanoString Technologies, Inc. was founded in 2003 and is headquartered in Seattle, Washington.

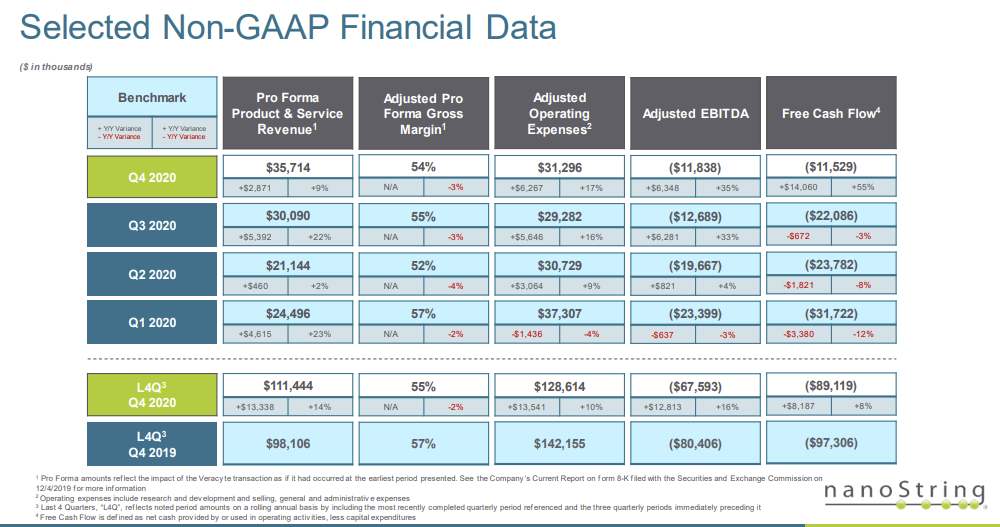

At $3 billion in market cap, I think investors should take a close look at $NSTG for their portfolios. The recent pullback in growth may give investors a favorable entry point. Based on the company’s latest communications with the public, the company is about to turn positive on a free cash flow basis:

This significant turn toward free cash flow positivity is largely the result of commercial story ramping as well as management focusing on controlling operating expense:

This favorable trend, combined with the company’s quite strong cash position, leaves $NSTG one of my favorites in this innovative sector.

The $60 strike price puts expiring on March 19 are a great sell at $2.00 per contract. This would give traders a 3.3% return on notional capital at risk in less than a week - compelling on an annualized basis! Best of luck.